MemeCoinCook.com serves up spicy crypto memes and info for entertainment only—this ain’t financial, investment, legal, or professional advice! Whipped up with AI flair, our content might have some half-baked bits, so DYOR before you dive into the crypto pot. NFA, folks—we’re just tossing out ideas, not guarantees. We make no claims about the accuracy, legality, or tastiness of our posts. Sip our content at your own risk! Check our Terms of Use for the full recipe.

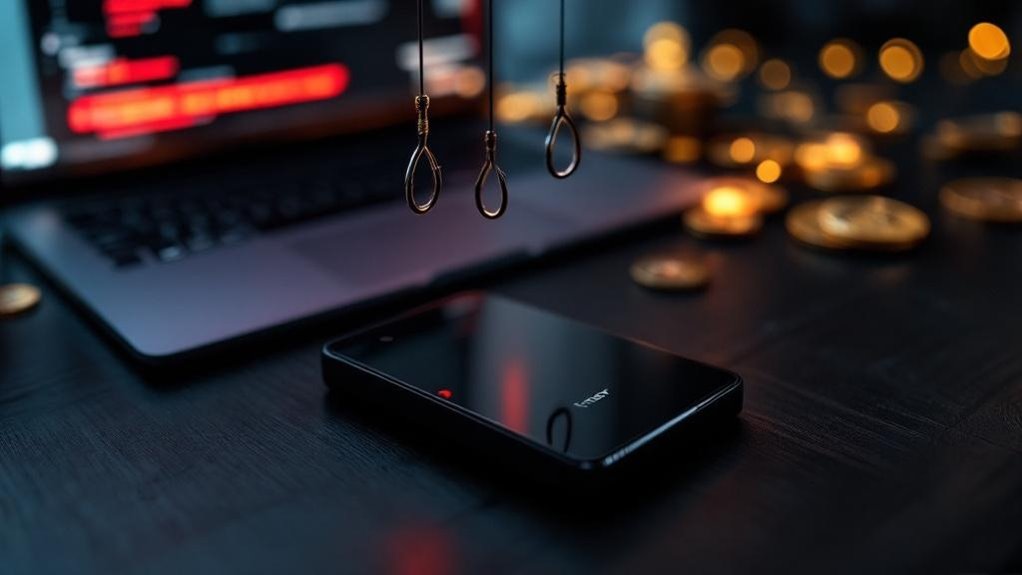

2.1B Vanishes in Crypto Thefts as Hackers Exploit People, Not Code in 2025

How did cryptocurrency theft reach such staggering heights in just three months? The answer lies not in broken code, but in broken trust. During the first quarter of 2025, hackers made off with over $1.77 billion in digital assets, marking one of the darkest periods in crypto history.

$1.77 billion stolen in three months—not through broken code, but broken trust.

The Bybit hack in February alone accounted for nearly 85% of this massive haul. To put this in perspective, hackers stole more in Q1 2025 than during the entire first half of 2024. The Bybit incident was three times larger than all crypto thefts combined in Q1 2023. These aren’t just numbers on a screen—they represent countless investors watching their holdings vanish into digital smoke.

What makes these attacks particularly concerning is their evolution. Modern crypto thieves don’t always need to crack complex blockchain algorithms. Instead, they’re exploiting the weakest link in any security system: people. Through psychological manipulation and social engineering, hackers convince users to hand over their private keys willingly. These tactics often involve spreading FUD campaigns to create panic and confusion, making victims more susceptible to scams. This professionalization of scams has reshaped the entire threat landscape, transforming amateur criminals into sophisticated operations. It’s like giving someone your house keys because they wore a convincing delivery uniform.

North Korean hackers have emerged as particularly skilled players in this dangerous game. In 2024, they stole $1.34 billion, representing 61% of all crypto thefts that year. Their tactics include infiltrating crypto companies with IT workers and stealing private keys through network compromises. These funds allegedly support North Korea’s economy, turning digital theft into a geopolitical issue.

The broader implications extend beyond simple theft. Ransomware payments hit record highs in 2024, while terrorist groups increasingly turn to cryptocurrencies for financing. Digital assets have become tools for sanctions evasion and illicit drug sales, creating headaches for regulators worldwide. Despite these mounting challenges, overall illicit crypto volume actually declined by 24% in 2024, suggesting that enforcement efforts may be having some impact even as specific attack vectors intensify.

The crypto ecosystem stands at a crossroads. While blockchain technology remains fundamentally secure, the human element creates vulnerabilities that hackers enthusiastically exploit. As one security expert might say, “You can’t patch human nature with a software update.”

Until the industry develops better safeguards against social engineering, investors must remember the golden rule: DYOR and never share those private keys.