MemeCoinCook.com serves up spicy crypto memes and info for entertainment only—this ain’t financial, investment, legal, or professional advice! Whipped up with AI flair, our content might have some half-baked bits, so DYOR before you dive into the crypto pot. NFA, folks—we’re just tossing out ideas, not guarantees. We make no claims about the accuracy, legality, or tastiness of our posts. Sip our content at your own risk! Check our Terms of Use for the full recipe.

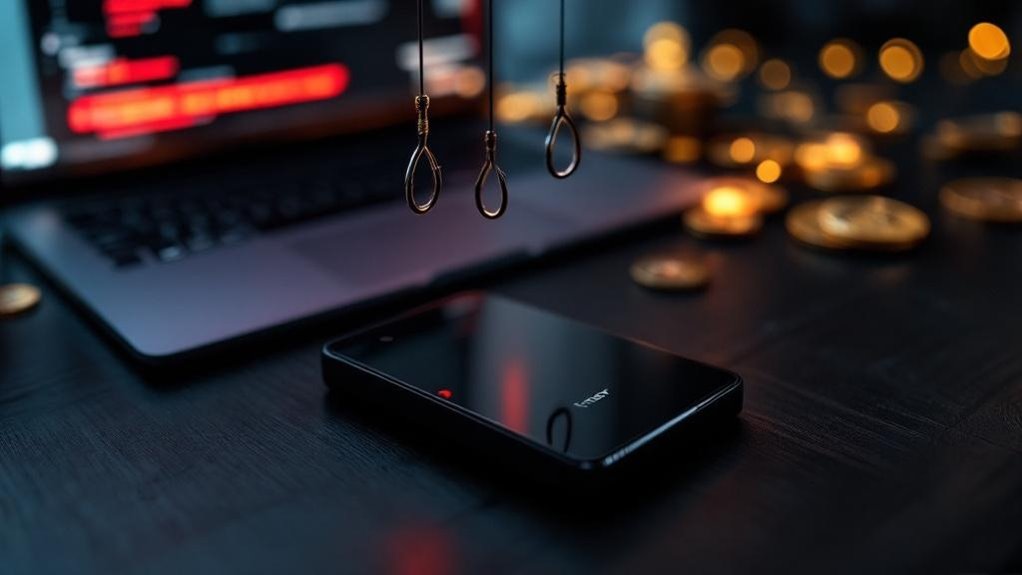

The Deceptive Crypto Scam That’s Stealing Millions Through Your Own Wallet History

The digital age has birthed countless innovations, but with them come sophisticated schemes designed to separate people from their hard-earned crypto. Among the most deceptive tactics emerging today is a scam that weaponizes users’ own wallet transaction histories against them. This clever manipulation has contributed to the staggering $9.9 billion lost to crypto scams in 2024 alone.

The scam works by exploiting the public nature of blockchain transactions. Scammers analyze wallet histories to identify patterns, frequent trading pairs, and transaction amounts. They then create fake wallets or phishing sites that mirror legitimate services users have previously interacted with. When victims see familiar transaction patterns or wallet addresses in their history, they’re more likely to trust the fraudulent platform. It’s like a digital déjà vu that tricks the brain into feeling safe.

Scammers weaponize your wallet history to create digital déjà vu that tricks you into trusting fraudulent platforms.

These criminals employ sophisticated social engineering techniques alongside their wallet history analysis. They might send phishing emails referencing specific past transactions or create fake scenarios that seem connected to previous crypto activities. The psychological impact is powerful – seeing accurate details about past transactions makes victims believe they’re dealing with legitimate services. This professionalization mirrors a broader trend where transnational organized crime groups now leverage cryptocurrency infrastructure to facilitate multiple crime types simultaneously. Once trust is established, users transfer funds into compromised wallets, never to see their crypto again.

The impact extends beyond individual losses. These scams damage the reputation of legitimate crypto services and have prompted increased regulatory scrutiny from bodies like the DFPI. As one security expert noted, these schemes are constantly evolving, adapting to new security measures faster than most users can keep up. The prevalence of such schemes is particularly concerning given that illicit crypto volume declined by 24% in 2024, yet scams and fraud remained among the most significant threats in the crypto ecosystem. Market manipulators often spread FUD tactics to trigger panic selling, creating additional vulnerability windows for scammers to exploit confused and emotional investors.

Protection requires vigilance and skepticism. Users should independently verify wallet addresses, never trust unsolicited communications about past transactions, and use hardware wallets when possible. Remember that legitimate services won’t ask for private keys or seed phrases, regardless of how much they seem to know about transaction history.

The crypto landscape continues to mature, but so do the tactics of those seeking to exploit it. Understanding these schemes is the first step in protecting digital assets from increasingly sophisticated attacks.

This isn’t financial advice—trade at your own risk.